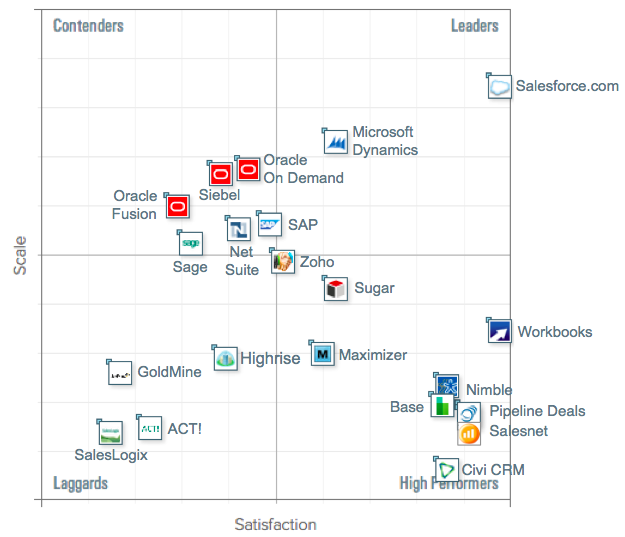

Salesforce.com is the top-ranked CRM solution featured in the CRM Grid of the crowd-sourced software review and evaluation website G2 Crowd.

Salesforce.com is the top-ranked CRM solution featured in the CRM Grid of the crowd-sourced software review and evaluation website G2 Crowd.

G2 describes itself as a user-driven software review site. Here’s their mission statement:

The current approach to buying business technology is broken. Buyers spend too much time sifting through spin, reading outdated analyst reports, and sitting through endless meetings. After all this, buyers still lack confidence in their choice of technology and most projects fail to meet their expectations. We will change this. By capturing our collective wisdom, we will make purchasing business technology as easy as buying consumer products.

As the chart above illustrates, Salesforce.com earned the highest overall score, followed by Microsoft Dynamics.

Several vendors earned High Performer status by achieving high customer satisfaction, but they do not yet have the market share and global scale required to get themselves into the Leaders’ quadrant.

The top High Performers include SugarCRM, Workbooks, Salesnet, and Nimble .

The CRM Grid rated Oracle, SAP, Sage, and NetSuite as Contenders, meaning that these vendors have significant scale and market share, but below-average user satisfaction ratings.

The top ranking was validated this week when the founders of Oracle and Salesforce.com, Larry Ellison and Mark Benioff, announced that after years of fierce competition they are getting into bed together.

Salesforce.com will embrace Oracle’s new multi-tennant 12C (c stands for cloud) database technology and introduce the Oracle Exadata hardware into its datacenters, while Oracle will integrate Salesforce.com into its Fusion HCM (Human Capital Management) HR and Financial Cloud (ERP) products.

Critically, from the CRM perspective, Oracle acknowledged that it will start using Salesforce.com itself.

Whilst the developments are interpreted by analysts as good news for Oracle’s infrastructure business, any company with one of Oracle’s CRM products (Siebel, Fusion CRM, CRM on Demand, RightNow CRM, E-Business Suite CRM or PeopleSoft CRM) should be wondering about their place in the landscape given these statements this week from Oracle’s Ellison during the announcement conference call for the media and the analyst community:

“Almost every time we buy a Company, they’re running Salesforce.com CRM. And, in the old days, we would try to move them over to our sales automation application — the Fusion sales automation application right away. We’re going to leave some of those companies on the Salesforce application for this specific purpose of making sure our integrations — that’s why I say we’re going to become a user of Salesforce.com’s CRM applications. We’re going to leave those implementations in place. We’re going to wire them up to our financials, and we’re going to be an early adopter of these out-of-the-box integrations. So, I mean obviously — I am sure Marc can do a better job than me of telling you just how successful Salesforce.com has been in CRM. But, we see them all over the market. They’re the market leader, and our customers expect for us to work gracefully with Salesforce.com. Both at the application level and the Company level.

“You’ve got to be able to turn on the Salesforce CRM applications, the Oracle HCM or ERP applications. And those things just have to start sharing data and working together – the key word being seamlessly . . . and that’s what Marc and I are committed to working on.”

It wasn’t stated explicitly during the announcement, but the Salesforce.com alliance relegates Oracle’s own CRM applications _ which it has recently started promoting as “Customer Experience Solutions” that customers can “Enhance, Augment and Migrate” _ to the rear-vision mirror. They will still compete with Salesforce.com (they will not go away anytime soon) but the case for any of them suddenly became a lot harder to make even allowing for Oracle’s formidable, hard-core “no prisoners” sales culture (which is, in fact, very similar to Salesforce’s).

The company’s new-generation Fusion CRM product has failed to win any reference customers. The two deployments which were announced in 2011, Siemens and Green Mountain Coffee, have apparently hit the proverbial rocks.

Siemens appears to have abandoned its implementation and Green Mountain Coffee is reportedly unhappy.

Critically, Oracle isn’t promoting any positive Fusion CRM customers on its dot com website. Only two old Siebel “customer highlights” are featured in the CRM section. If you have the time, click on the Gartner Research panel on the page. Two of the three Gartner links have expired. The one active link leads to an out-of-date 2011 report. Could this be because Gartner now agrees with the G2 Crowd users?

Today the conventional, on-premise Siebel platform, which Oracle purchased in 2005 for $US 5.8bn, is nearing the end of its 20+ year life cycle.

R8, which was introduced in 2007, is the last major Siebel release and recently there have been a wave of significant defections, which have shrunk Oracle’s flow of license maintenance revenue (on which its margins are reportedly as high as 90%).

Companies as diverse as IBM, Kimberly Clarke, Microsoft, Hewlett Packard, Bayer, Forrester Research and Corporate Executive Board have all walked away from Siebel in recent years.

Oracle’s user interface product, Open UI, is cited as a solution to Siebel’s usability issues, but as one leading analyst told me recently it is no more than “lipstick”. And despite being released in 2012 there are still no reference customers.

Customers of the marketing automation tool, Eloqua (now called Oracle Marketing), that Oracle bought last year no longer face a fork in the road. The vast majority are Salesforce.com users.

And the newly-christened Customer Experience Suite, which includes Oracle Marketing (Eloqua) and other acquisitions Oracle Commerce (ATG, Endeca), Oracle Sales (Oracle CRM On Demand), Oracle Service (RightNow), Oracle Social (Collective Intellect, Vitrue, Involver), and Oracle Content (Fatwire) faces an interesting positioning challenge (whilst integration itself remains a massive work in progress).

Finally, the Benioff-Ellison bromance has reignited speculation that Oracle & Salesforce.com could one day exchange equity, with Benioff becoming Ellison’s successor. Watch this space, as they say.